Contents

The low national income is the main reason of the low power to save in India. Demonetisation helps in curbing black money, reducing tax evasion and corruption will decrease. It also help in tax administration https://1investing.in/ in another way, by shifting transaction out of the cash economy into the formal payment system. Now a days, households and firms have started to shift from cash payment to electronic payments.

Explain the effect of an autonomous change in aggregate demand on income and output. The above equation is called the consumption function. Here C is the consumption expenditure by households. This consists of two components autonomous consumption and induced consumption . The aggregate demand function is parallel to the consumption function i.e., they have the same slope c. If the equilibrium level of output is less than the full employment of output, then it is called as deficient demand.

What is Paradox Of Thrift?

In Micro Economics, each individual economic agent thinks about its own interest and welfare. If these four conditions are satisfied, the market is said to be purely competitive. In other words, a market characterized by the presence of these four features is called purely competitive. For a market to be perfect, some conditions of perfection of the market must also be fulfilled.

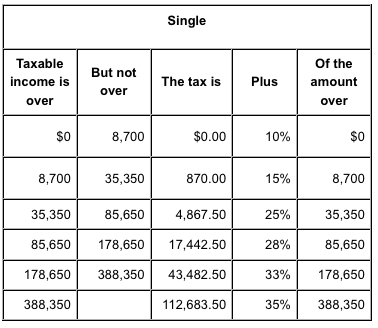

People were taught that thrift or savings are good because a penny saved today will bring increased income. Line I shows the relationship between investment spending and Gross Domestic Product . Line S shows the correlation between savings and GDP. When people wish to increase savings from S to S1, it leads to a fall in real investment and income . The stock market crashed in 1929, a huge blow for investors, banks, financial institutions, and businesses. People lost hope in the banking and financial systems.

When such a change in consumption patterns occurs in society, it triggers a vicious cycle. Demand falls—business output falls—more unemployment—recession increases. Keynes helped revive the circular flow model of the economy. This theory states that an increase in current spending drives future spending. Current spending, after all, results in more income for current producers.

What is ‘Paradox of Thrift’

While the move helped families save money on rent and other expenses, it caused estimated damages of as much as $25 billion per year to the economy. To boost current spending, Keynes argued for lower interest rates to lower current savings rates. If low interest rates do not create more borrowing and spending, Keynes said, the government could engage in deficit spending to fill the gap. The first conceptual description of the paradox of thrift may have been written in Bernard Mandeville’s “The Fable of the Bees” .

Such a situation is harmful for everybody as investments give lower returns than normal. The circular flow model ignores the lesson of Say’s law, which states goods must be produced before they can be exchanged. Capital machines, which drive higher levels of production, require additional savings and investment. The circular flow model only works in a framework without capital goods. Thus an accumulation of savings yields an increase in potential lending, which will lower interest rates and stimulate borrowing. So a decline in consumer spending is offset by an increase in lending, and subsequent investment and spending.

On the contrary, expenditure tax encourages savings because to avoid this tax, people save more out of their income instead of spending it. GDP at factor cost is gross domestic product at market prices minus net indirect taxes. It measures money value of output produced by the firms within the domestic boundaries of a country in a year. Let us discuss in detail why there will be no super normal profit or no loss to the firms. Suppose, at the prevailing market price, each firm is earning super normal profit.

However, exercising thrift may be good for an individual by enabling that individual to save for a “rainy day”, and yet not be good for the economy as a whole. In countries like India where agriculture is the main occupation, power to save depends upon the development of agriculture also. Agricultural development increases income which results in an increase in the power to save. Industrial development increases the power to save through the increase in income.

Paradox of Thrift

Keynesians believe a recessed economy does not produce at full capacity because some of its factors of production are unemployed. An increase in thrift on the part of an individual leads to greater saving and wealth. It is also regarded a public virtue because if people consume less, then more resources can be devoted to producing capital goods which lead to increase in income, output and employment.

The theory is referred to as the “paradox of thrift” in Samuelson’s influential Economics of 1948, which popularized the term. Savings depend not only on the will and the power to save they also depend upon the facility to save. A farsighted person wants to make provision for education, marriage, etc. of his children. All this can be done by savings in the present time. A portion of the income can be saved only if a person has the will to save.

In the first stage of macroeconomics theory, we are taking the price level as fixed. To optimize production, businesses need savings and capital investment. In real-world scenarios, production depends on variables like technology and the level of competition. Upgrading technology also requires substantial capital investment; savings can facilitate that.

- This consumer behavior is witnessed during a recession—consumers save more to prepare themselves for the worst.

- However, a recession strikes and Ivan reverts to savings mode.

- GDP at factor cost is gross domestic product at market prices minus net indirect taxes.

- ∴Equilibrium quantity is supplied and demand is 160.

- Upgrading technology also requires substantial capital investment; savings can facilitate that.

Consumers prioritized future needs and future survival. The economy collapsed, giving rise to the great depression of 1929. A real world example of the savings paradox during the Great Recession was the case of 25- to 29-year-olds who moved in with their parents. The percentage of such people increased from 14% in 2005 to 19% in 2011.

d PUC Economics Question Bank Chapter 10 Income Determination

Two parallel lines denote the shift in the relationship between savings and income. In the above graph, the Y-axis represents savings, and the give the meaning of paradox of thrift X-axis represents income. Curve SS provides the point of equilibrium at point E. The paradox of thrift explained Archived from the original.

The offers that appear in this table are from partnerships from which Investopedia receives compensation. This compensation may impact how and where listings appear. Investopedia does not include all offers available in the marketplace.

Scarce investment opportunities result in fewer saving. People save less for fear of fall in the money value Stability in the price level or the value of money encourages savings. Therefore, the power to save of the people in a country depends on their income or factors affecting their income.

Similarly, if the firms are incurring loss at the prevailing price, some firms will exit. Then the profits of each firm will increase to the level of normal profit. At this point, no firm will want to leave since they will be earning normal profit. There must be such a large number of buyers that no one buyer is able to influence the market price in any way. Each buyer should purchase just a fraction of the market supplies. Further the buyers should have any kind of union or association so that they compete for the market demand on an individual basis.

Find the quantity of demand and supply when P is lesser than equilibrium price. Find the quantity of demand and supply when P is greater than equilibrium price. The demand function is a relation between the amount of the good and its price when other things remain constant. Therefore, with free entry and exit, each firm will always earn normal profit at the prevailing market price.

At this point, with all firms in the market earning normal profit. In perfect competitive market, it is assumed that there will be free entry and exit of firms. This assumption implies that in equilibrium, no firm earns super normal profit or incurs loss by remaining in production. Here, the equilibrium price will be equal to the minimum average cost of the firms. As people become more thrifty, they end up saving less or same as before in aggregate, known as paradox of thrift. It states that individuals try to save more during an economic recession, which essentially leads to a fall in aggregate demand and hence in economic growth.

Economics

This will make interest rates go down and lead to an increase in lending and, therefore, spending. If demand decreases, supply also increases, causing the price to rise . But the paradox concept does not consider the equilibrium of demand and supply. Rather it assumes that the price of products will remain unchanged. The individual choices of one individual create a massive impact because many individuals opt for the same strategy.

Recent Comments